Midascom Network Sdn Bhd

Malaysia Diesel Genset (Generator) Market (2021-2027) | Industry, Revenue, Size, Companies, Forecast, Growth, COVID-19 IMPACT, Share, Value, Analysis & Trends

Malaysia Diesel Genset Market | Country-Wise Share and Competition Analysis

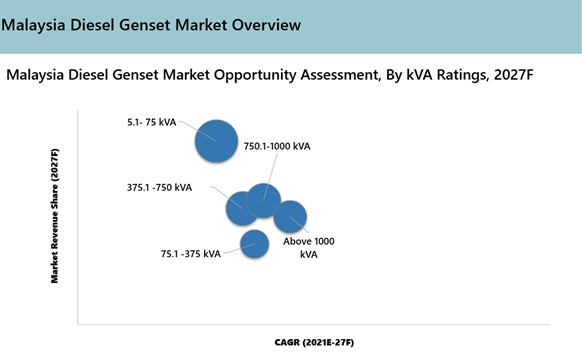

Market Forecast By KVA Ratings (5.1 To 75 KVA, 75.1 – 375 KVA, 375.1 - 750 KVA, 750.1 - 1000 KVA, Above 1000 KVA), By Verticals (Mining, Manufacturing, Hospitality, Service Sector, Residential, Telecom, Others) And Competitive Landscape

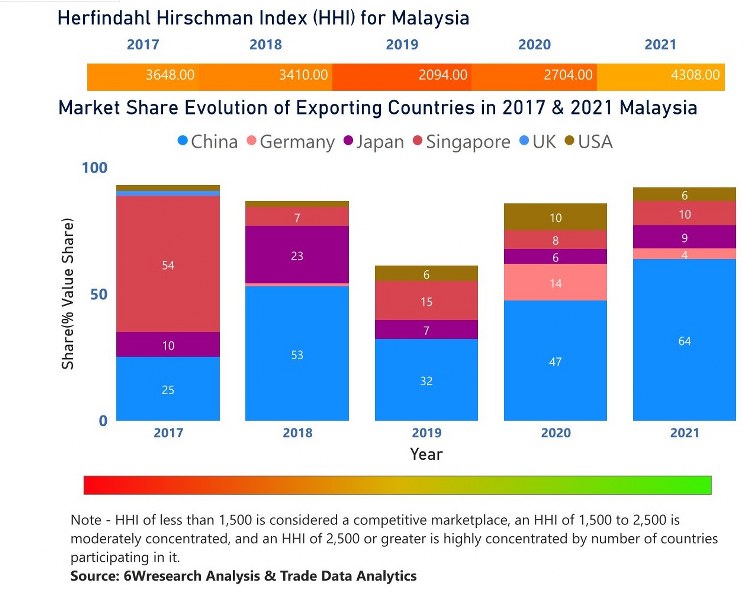

In the year 2021, China was the largest exporter in terms of value, followed by Singapore. It has registered a growth of 2.97% over the previous year. While Singapore registered a decline of -2.75% as compare to the previous year. In the year 2017 Singapore was the largest exporter followed by China. In term of Herfindahl Index, which measures the competitiveness of countries exporting, Malaysia has the Herfindahl index of 3648 in 2017 which signifies high concentration also in 2021 it registered a Herfindahl index of 4308 which signifies high concentration in the market.

Malaysia Diesel Genset Market - Export Market Opportunities

Malaysia Diesel Genset Market report thoroughly covers the market by kVA ratings and applications. The report provides an unbiased and detailed analysis of the on-going trends, opportunities / high growth areas, market drivers, and market revenue ranking by companies, which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Malaysia Diesel Genset Market Synopsis

Malaysia diesel genset market slowed in 2019 due to oil price volatility, followed by the outbreak of Covid19, which the government imposed a lockdown as a step towards a national blockade in 202 due to which all construction activities were closed and supply & demand chain for diesel generators was disrupted.

However, due to the opening of borders and the gradual recovery of domestic economic activity, the market is likely to rebound after 2021. Furthermore, country significantly relies on diesel generator sets for power backup solutions, the diesel generator market is likely to increase considerably throughout the forecast period. Moreover, with an increase in the number of data centres in the country, a positive outlook for the manufacturing and mining sectors, an increase in current and future residential and commercial projects, and a growing government focus on transportation and public infrastructure development, demand for diesel generators is expected to rise in the coming years.

According to researchers, Malaysia Diesel Genset Market size is projected to grow at CAGR of 5.8% during 2021-27. The country’s focus on the 4th industrial revolution via National 4IR Policy launched in July 2021 has led to a growing need for stable and constant power solutions, which is projected to drive the diesel genset industry in the upcoming years. Additionally, Malaysia Vision 2025, Economic Transformation Programme, National Tourism Policy (NTP) 2020-2030, Penang Transport Master Plan (PTMP) are a few of the government initiatives, which aims at developing and strengthening sectors like residential, IT/ITES, BFSI, healthcare, education, infrastructure, and tourism, thereby creating a huge demand for power backup equipment for the developmental activities, leading to a surge in demand for DGs in Malaysia in the coming years.

Market by KVA Ratings Analysis

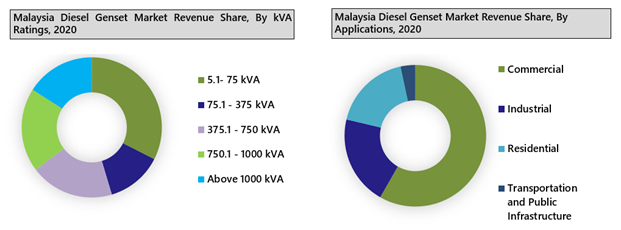

In terms of KVA Ratings, 5.1-75 kVA, 75.1-375 kVA, 375.1-750 kVA cumulatively have captured 65% of the market revenues in 2020, with 5.1-75 KVA leading the market. The segment 5.1- 75 kVA generated majority of the market revenue share in 2020 and are expected to retain their dominance over the forthcoming years due to their rising demand in residential, small commercial offices, retail stores, and telecom towers. However, above 1000 kVA segment is predicted to grow fastest in the forecast period on account of growing usage of these gensets in high-end industries and energy & utility sectors like data centers where power demand is in high megawatts.

In terms of KVA Ratings, 5.1-75 kVA, 75.1-375 kVA, 375.1-750 kVA cumulatively have captured 65% of the market revenues in 2020, with 5.1-75 KVA leading the market. The segment 5.1- 75 kVA generated majority of the market revenue share in 2020 and are expected to retain their dominance over the forthcoming years due to their rising demand in residential, small commercial offices, retail stores, and telecom towers. However, above 1000 kVA segment is predicted to grow fastest in the forecast period on account of growing usage of these gensets in high-end industries and energy & utility sectors like data centers where power demand is in high megawatts.

The Malaysia diesel genset market revenue is anticipated to record a CAGR of 5.8% during 2021-27. By kVA Ratings, 5.1-75 kVA segment has dominated the market revenues led by usage across commercial and residential segments. By kVA Ratings, Above 1000 kVA segment would record key growth throughout the forecast period 2021-27. The key players of the market include- Caterpillar Inc., Cummins Inc., Yanmar Holdings Co. Ltd., Kohler Co., Rolls-Royce Power Systems AG, Atlas Copco AB., Mitsubishi Heavy Industries Ltd., AB Volvo (publ), Denyo Co., Ltd., and Deutz AG. © Copyright 2025 | Midascom Network Sdn Bhd All Rights Reserved

Malaysia Diesel Genset (Generator) Market - FAQs

How much growth is expected in the Malaysia diesel genset market over the coming years?

Which segment has captured key share of the market?

Which segment is exhibited to gain traction over the forecast period?

Who are key the key players of the market?